OK, so as summer is upon us also (supposedly) we get closer to the day where the purchase transaction will occur!

For many, the new NSX will be the most expensive car ever purchased – equivalent to buying a small house in many states. How are you planning to pay for your new NSX - cash, lease, finance, trade up, sell your firstborn child??

Looking for tips and thoughts on what might be a once-in-a-lifetime transaction...

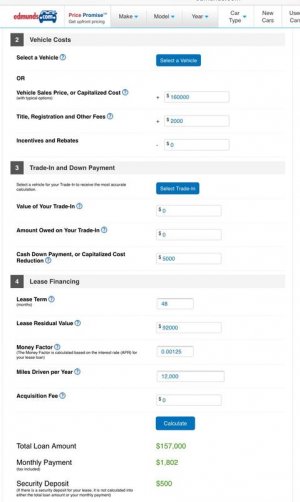

(I'll kick things off by sharing that the Pentagon Federal Credit Union has offered some pretty aggressive lending rates in the past.)

For many, the new NSX will be the most expensive car ever purchased – equivalent to buying a small house in many states. How are you planning to pay for your new NSX - cash, lease, finance, trade up, sell your firstborn child??

Looking for tips and thoughts on what might be a once-in-a-lifetime transaction...

(I'll kick things off by sharing that the Pentagon Federal Credit Union has offered some pretty aggressive lending rates in the past.)