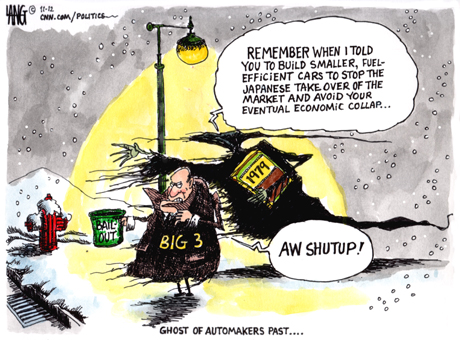

Found this on Mazda Forum...

GM today announced a third-quarter loss of $4.2 billion on revenues of $37 billion while spending $6.9 billion of their lifeblood-like cash on hand. Although initially we thought the big news here was a cash spend of $2.3 billion per month, compared to around $1.1 billion a month in the previous quarter, but the real story is that GM basically acknowledged what we said first last month that bankruptcy is imminent (and we might add, were laughed at by some members of the auto intelligentsia for it) — as close as the end of the year if GM doesn't receive help.

Why is the cash burn rate so important? GM isn't exactly cash rich and needs to have at least $10 billion to operate and currently has around $15.8 billion on hand. This means that if the current trend continues the company will be unable to operate in approximately three months, meaning that they'll have to declare bankruptcy as we previously outlined. GM itself basically admits this themselves saying:

"Even if GM implements the planned operating actions that are substantially within its control, GM's estimated liquidity during the remainder of 2008 will approach the minimum amount necessary to operate its business. Looking into the first two quarters of 2009, even with its planned actions, the company's estimated liquidity will fall significantly short of that amount unless economic and automotive industry conditions significantly improve, it receives substantial proceeds from asset sales, takes more aggressive working capital initiatives, gains access to capital markets and other private sources of funding, receives government funding under one or more current or future programs, or some combination of the foregoing."

To summarize: give us some money or we're going to go bankrupt and the economy will have to grapple with the horror of hundreds of thousands of unemployed workers. Announcement from General Motors below.

Quote:

GM Reports Third Quarter Financial Results

DETROIT –General Motors (NYSE: GM) today announced its financial results for the third quarter of 2008, reflecting rapidly deteriorating market conditions in the U.S., slowdowns in other mature markets around the world, and continued losses at GMAC Financial Services (GMAC).

During the third quarter the turmoil in the global credit markets resulted in the worst financial crisis in more than 70 years. The upheaval has had a dramatic impact on the auto business in particular, especially in the U.S. and Western Europe.

Tight credit, rising unemployment, declining income, falling stock markets, and continuing deterioration in the housing market in the U.S., resulted in an abrupt halt in consumer spending, with most consumers exiting the vehicle market. Many of those still intending to purchase vehicles were denied financing, or found the cost of financing prohibitive.

“The third quarter was especially challenging for the auto industry. Consumer spending, which represents close to 70 percent of the U.S. economy, fell dramatically, and the abrupt closure of credit markets created a downward spiral in vehicle sales,” said Rick Wagoner, Chairman and Chief Executive Officer. “The U.S. government’s actions to help stabilize the credit markets and eventually ease the credit crunch are an essential first step to the economy’s and the auto industry’s recovery, but further strong action is required.”

GM reported a net loss of $2.5 billion or $4.45 per share for the third quarter, including special items. That compares with a net loss from continuing operations of $42.5 billion or $75.12 per share in the third quarter of 2007, which included a non-cash charge of $38.3 billion to establish a valuation allowance against some of the company’s net deferred tax assets.

On an adjusted basis, GM posted a net loss of $4.2 billion or $7.35 per share, compared with a net loss from continuing operations of $1.6 billion or $2.86 per share in the same period last year.

Revenue for the third quarter was $37.9 billion, down from $43.7 billion in the year-ago quarter, reflecting dramatic sales declines across the industry driven by unstable market conditions, instability in the credit markets and dramatic retraction in consumer demand, especially in North America and Europe.

GM recorded net favorable charges of $1.7 billion for special items in the third quarter. Included in the charges was a curtailment gain of $4.9 billion resulting from the UAW Settlement Agreement becoming effective. The curtailment represents the accelerated recognition of net prior service credits, largely relating to the 2005 GM UAW healthcare agreement, scheduled for amortization after January 1, 2010.

The curtailment was recorded because GM's UAW retiree health plan will not exist after January 1, 2010, and therefore no further basis for deferring unamortized prior service credits exists beyond that date. The $4.9 billion curtailment gain was partially offset by a non-cash $1.7 billion settlement charge related to the elimination of post-65 salaried retiree healthcare coverage, including the cost of increased pension benefits that were announced in July as part of GM’s operating actions to improve liquidity as well as the recognition of accumulated deferred losses related to the healthcare plan.

In addition, GM reported charges of $652 million relating to its commitments as part of Delphi’s bankruptcy proceedings, $251 million for impairment of investments in GMAC, and $641 million in restructuring-related and other charges. Details on these and all other special items are in the financial highlights section of this release.

GM Automotive Operations

GM reports its automotive operations and regional results on an earnings-before-tax basis, with taxes reported on a total corporate basis.

GM recorded an adjusted automotive loss of $2.8 billion ($947 million reported loss) in the third quarter 2008. The loss compares with adjusted automotive earnings from continuing operations of $98 million in the third quarter of 2007 (reported net loss of $1.6 billion).

The results reflect losses in GM North America (GMNA) driven largely by the U.S. industry volume decline of nearly 20 percent, and shifts in product mix. In addition, Europe saw rapid auto market contraction, leading to sharply lower GM Europe (GME) sales volume in the third quarter. GM Asia Pacific (GMAP) results were down due to commodity hedging charges and moderating demand in key markets including China, Australia and India. These losses were partially offset by very strong results in the GM Latin America, Africa and Middle East (GMLAAM) region.

GM’s automotive results in the third quarter include $1.5 billion of expenses related to mark-to-market changes in the value of GM’s commodity and foreign exchange hedging contracts, due almost entirely to falling commodity prices.

GM sold 2.1 million vehicles worldwide in the third quarter, down 11 percent year over year. Sales in GMNA were down 19 percent compared to third quarter 2007. GM global market share was 13 percent, down 0.7 percentage points compared with the third quarter of 2007, due largely to weakness in North America and Western Europe.

Cash and Liquidity

Cash, marketable securities, and readily-available assets of the Voluntary Employees’ Beneficiary Association (VEBA) trust totaled $16.2 billion on September 30, 2008, down from $21.0 billion on June 30, 2008.

The change in liquidity reflects negative adjusted operating cash flow of $6.9 billion in the third quarter 2008, driven by the industry-wide slowdown in vehicle demand and compounding credit crisis, especially in North America and Europe. During the quarter, GM drew the remaining $3.5 billion of its secured revolving credit facility and made $1.2 billion in payments to Delphi as required by agreements between the companies as part of Delphi’s bankruptcy proceedings.

GM expects adjusted operating cash flow in the fourth quarter to be much improved versus the third quarter, and more consistent with the first half of the year. Improvements in fourth quarter cash flow are largely driven by anticipated improvements in working capital in North America relating to sales allowances, and lower fourth quarter finished vehicle inventory in Europe.

Improving its liquidity position remains a top priority for the company. In response to deteriorating market conditions, GM announced today that in addition to the $15 billion in liquidity initiatives it outlined in July 2008, it has identified $5 billion of incremental liquidity actions. Cumulatively, GM has announced actions aimed at improving liquidity by $20 billion through 2009. To date, $10 billion in internal operating actions have either already been completed or are on track for full execution by the end of 2009.

Even if GM implements the planned operating actions that are substantially within its control, GM's estimated liquidity during the remainder of 2008 will approach the minimum amount necessary to operate its business. Looking into the first two quarters of 2009, even with its planned actions, the company's estimated liquidity will fall significantly short of that amount unless economic and automotive industry conditions significantly improve, it receives substantial proceeds from asset sales, takes more aggressive working capital initiatives, gains access to capital markets and other private sources of funding, receives government funding under one or more current or future programs, or some combination of the foregoing. The success of GM's plans necessarily depends on other factors, including global economic conditions and the level of automotive sales, particularly in the United States and Western Europe.

GM today announced a third-quarter loss of $4.2 billion on revenues of $37 billion while spending $6.9 billion of their lifeblood-like cash on hand. Although initially we thought the big news here was a cash spend of $2.3 billion per month, compared to around $1.1 billion a month in the previous quarter, but the real story is that GM basically acknowledged what we said first last month that bankruptcy is imminent (and we might add, were laughed at by some members of the auto intelligentsia for it) — as close as the end of the year if GM doesn't receive help.

Why is the cash burn rate so important? GM isn't exactly cash rich and needs to have at least $10 billion to operate and currently has around $15.8 billion on hand. This means that if the current trend continues the company will be unable to operate in approximately three months, meaning that they'll have to declare bankruptcy as we previously outlined. GM itself basically admits this themselves saying:

"Even if GM implements the planned operating actions that are substantially within its control, GM's estimated liquidity during the remainder of 2008 will approach the minimum amount necessary to operate its business. Looking into the first two quarters of 2009, even with its planned actions, the company's estimated liquidity will fall significantly short of that amount unless economic and automotive industry conditions significantly improve, it receives substantial proceeds from asset sales, takes more aggressive working capital initiatives, gains access to capital markets and other private sources of funding, receives government funding under one or more current or future programs, or some combination of the foregoing."

To summarize: give us some money or we're going to go bankrupt and the economy will have to grapple with the horror of hundreds of thousands of unemployed workers. Announcement from General Motors below.

Quote:

GM Reports Third Quarter Financial Results

DETROIT –General Motors (NYSE: GM) today announced its financial results for the third quarter of 2008, reflecting rapidly deteriorating market conditions in the U.S., slowdowns in other mature markets around the world, and continued losses at GMAC Financial Services (GMAC).

During the third quarter the turmoil in the global credit markets resulted in the worst financial crisis in more than 70 years. The upheaval has had a dramatic impact on the auto business in particular, especially in the U.S. and Western Europe.

Tight credit, rising unemployment, declining income, falling stock markets, and continuing deterioration in the housing market in the U.S., resulted in an abrupt halt in consumer spending, with most consumers exiting the vehicle market. Many of those still intending to purchase vehicles were denied financing, or found the cost of financing prohibitive.

“The third quarter was especially challenging for the auto industry. Consumer spending, which represents close to 70 percent of the U.S. economy, fell dramatically, and the abrupt closure of credit markets created a downward spiral in vehicle sales,” said Rick Wagoner, Chairman and Chief Executive Officer. “The U.S. government’s actions to help stabilize the credit markets and eventually ease the credit crunch are an essential first step to the economy’s and the auto industry’s recovery, but further strong action is required.”

GM reported a net loss of $2.5 billion or $4.45 per share for the third quarter, including special items. That compares with a net loss from continuing operations of $42.5 billion or $75.12 per share in the third quarter of 2007, which included a non-cash charge of $38.3 billion to establish a valuation allowance against some of the company’s net deferred tax assets.

On an adjusted basis, GM posted a net loss of $4.2 billion or $7.35 per share, compared with a net loss from continuing operations of $1.6 billion or $2.86 per share in the same period last year.

Revenue for the third quarter was $37.9 billion, down from $43.7 billion in the year-ago quarter, reflecting dramatic sales declines across the industry driven by unstable market conditions, instability in the credit markets and dramatic retraction in consumer demand, especially in North America and Europe.

GM recorded net favorable charges of $1.7 billion for special items in the third quarter. Included in the charges was a curtailment gain of $4.9 billion resulting from the UAW Settlement Agreement becoming effective. The curtailment represents the accelerated recognition of net prior service credits, largely relating to the 2005 GM UAW healthcare agreement, scheduled for amortization after January 1, 2010.

The curtailment was recorded because GM's UAW retiree health plan will not exist after January 1, 2010, and therefore no further basis for deferring unamortized prior service credits exists beyond that date. The $4.9 billion curtailment gain was partially offset by a non-cash $1.7 billion settlement charge related to the elimination of post-65 salaried retiree healthcare coverage, including the cost of increased pension benefits that were announced in July as part of GM’s operating actions to improve liquidity as well as the recognition of accumulated deferred losses related to the healthcare plan.

In addition, GM reported charges of $652 million relating to its commitments as part of Delphi’s bankruptcy proceedings, $251 million for impairment of investments in GMAC, and $641 million in restructuring-related and other charges. Details on these and all other special items are in the financial highlights section of this release.

GM Automotive Operations

GM reports its automotive operations and regional results on an earnings-before-tax basis, with taxes reported on a total corporate basis.

GM recorded an adjusted automotive loss of $2.8 billion ($947 million reported loss) in the third quarter 2008. The loss compares with adjusted automotive earnings from continuing operations of $98 million in the third quarter of 2007 (reported net loss of $1.6 billion).

The results reflect losses in GM North America (GMNA) driven largely by the U.S. industry volume decline of nearly 20 percent, and shifts in product mix. In addition, Europe saw rapid auto market contraction, leading to sharply lower GM Europe (GME) sales volume in the third quarter. GM Asia Pacific (GMAP) results were down due to commodity hedging charges and moderating demand in key markets including China, Australia and India. These losses were partially offset by very strong results in the GM Latin America, Africa and Middle East (GMLAAM) region.

GM’s automotive results in the third quarter include $1.5 billion of expenses related to mark-to-market changes in the value of GM’s commodity and foreign exchange hedging contracts, due almost entirely to falling commodity prices.

GM sold 2.1 million vehicles worldwide in the third quarter, down 11 percent year over year. Sales in GMNA were down 19 percent compared to third quarter 2007. GM global market share was 13 percent, down 0.7 percentage points compared with the third quarter of 2007, due largely to weakness in North America and Western Europe.

Cash and Liquidity

Cash, marketable securities, and readily-available assets of the Voluntary Employees’ Beneficiary Association (VEBA) trust totaled $16.2 billion on September 30, 2008, down from $21.0 billion on June 30, 2008.

The change in liquidity reflects negative adjusted operating cash flow of $6.9 billion in the third quarter 2008, driven by the industry-wide slowdown in vehicle demand and compounding credit crisis, especially in North America and Europe. During the quarter, GM drew the remaining $3.5 billion of its secured revolving credit facility and made $1.2 billion in payments to Delphi as required by agreements between the companies as part of Delphi’s bankruptcy proceedings.

GM expects adjusted operating cash flow in the fourth quarter to be much improved versus the third quarter, and more consistent with the first half of the year. Improvements in fourth quarter cash flow are largely driven by anticipated improvements in working capital in North America relating to sales allowances, and lower fourth quarter finished vehicle inventory in Europe.

Improving its liquidity position remains a top priority for the company. In response to deteriorating market conditions, GM announced today that in addition to the $15 billion in liquidity initiatives it outlined in July 2008, it has identified $5 billion of incremental liquidity actions. Cumulatively, GM has announced actions aimed at improving liquidity by $20 billion through 2009. To date, $10 billion in internal operating actions have either already been completed or are on track for full execution by the end of 2009.

Even if GM implements the planned operating actions that are substantially within its control, GM's estimated liquidity during the remainder of 2008 will approach the minimum amount necessary to operate its business. Looking into the first two quarters of 2009, even with its planned actions, the company's estimated liquidity will fall significantly short of that amount unless economic and automotive industry conditions significantly improve, it receives substantial proceeds from asset sales, takes more aggressive working capital initiatives, gains access to capital markets and other private sources of funding, receives government funding under one or more current or future programs, or some combination of the foregoing. The success of GM's plans necessarily depends on other factors, including global economic conditions and the level of automotive sales, particularly in the United States and Western Europe.

Last edited: