I thought it’d be interesting to create a thread discussing Honda’s financial performance and business strategy and operations. There is a treasure trove and a sea of meaning behind business strategy and operations that can be uncovered by taking a look at what various ratios, press releases, and metrics reveal.

Things to discuss would be stock price, financial statements, key performance indicators, stats, market share, new models, old models, marketing, Honda vs. competitors, etc – not just strictly financial news but anything to do with Honda’s business.

Here are a few points of reference:

Honda web site

Honda Investor Relations

Honda Annual Report - 2013

Honda Financial News Aggregations Sources:

Google Finance

Yahoo Finance

SEC Filings

Reuters Research

Earnings Conference Call Transcripts

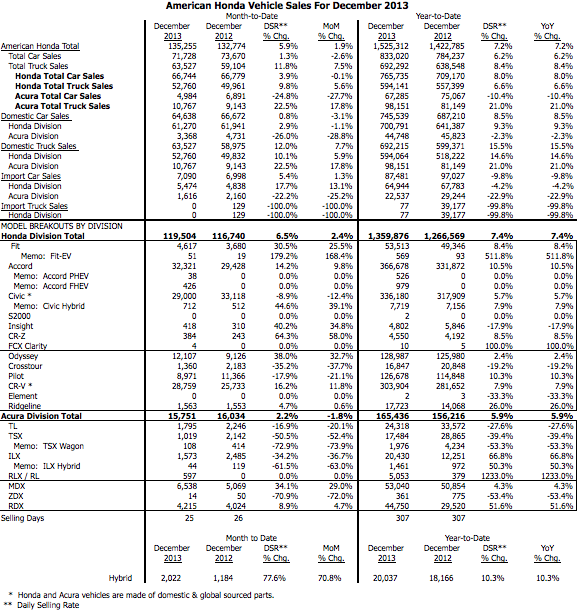

Couple of interesting notes:

So with that, I hope some good conversations get started and we all get better informed about the company that created our beloved NSX.

Things to discuss would be stock price, financial statements, key performance indicators, stats, market share, new models, old models, marketing, Honda vs. competitors, etc – not just strictly financial news but anything to do with Honda’s business.

Here are a few points of reference:

Honda web site

Honda Investor Relations

Honda Annual Report - 2013

Honda Financial News Aggregations Sources:

Google Finance

Yahoo Finance

SEC Filings

Reuters Research

Earnings Conference Call Transcripts

Couple of interesting notes:

- North America is Honda’s biggest market in terms of units sold and revenue. However, Asia, which is a distant third, is now close to eclipsing Japanese sales. If Asia ever eclipses the US in terms of revenue, Honda would seem to have no choice but to make that economic market a bigger priority. It’s growing at a 65% annual rate.

- 90% of Hondas and Acuras sold in the US are made in the US. What an amazing statistic.

- Honda Market Cap (01.01.13) is 74 billion. This is greater than GM, Ford, Chrysler, Nissan + Renault, and Mitsubishi. Toyota is at 193 billion. Honda faired the worldwide economic collapse well.

- Capital Expenditures have continued to increase - almost 30% in 2013. Global production capacity has increased to 5.5 million with 1.92 within the US.

So with that, I hope some good conversations get started and we all get better informed about the company that created our beloved NSX.